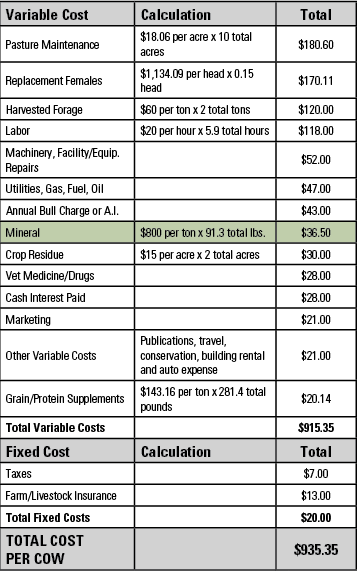

Everyone is looking for a deal, but does that mean you need to offer regular “deals” or promotions on your BioZyme® products? No, there is a definite time and place to use promotions, and having a regular sale isn’t always the best way to make a sale.

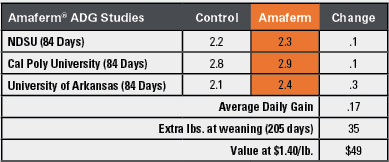

The value of BioZyme products is that they are high quality products that do exactly what they say they do. The products keep your animals healthy, and healthy animals grow faster and more efficiently. If a potential customer is skeptical, share the research or other customer testimonials with them. Chances are, you are going to gain a new customer who becomes a repeat customer.

But, your competitors down the road offer regular sales on their supplement products, and your lack of a “good deal” is the topic of conversation at the local coffee shop. Here are few ways to offer smart promotions, should you feel the need to do so.

Offer a short-term discount on something everyone can use. Most of your customers have a dog, so offer a discount on dog food with the purchase of a certain amount of VitaFerm® or Vitalize® mineral. This gives them the opportunity to try something new they might not have even known BioZyme offers, and makes you look like the good guy for offering a promotion.

Don’t offer a discount on in-season products. Did you order too much VitaFerm® HEAT™ mineral and you are approaching the cooler months? That would be a good time to discount that inventory to get it out of the warehouse, and perhaps customers will want to order more at regular price next summer.

Remember to advertise a “limited time promotion.” If you don’t, your customer might actually like the dog the food they bought last time with their supplement order, and will want you to honor that same price again. Remind the customer that it was a one-time promotion, but you are glad he/she liked the product, and will be glad to sell it to him/her at regular price.

Add value in other ways. Host a producer meeting to share the latest industry information. Invite your customers to a special VIP open house with refreshments and door prizes after store hours. Offer delivery. There are many ways of adding value to your products that won’t hurt your profit potential.

If conducted properly, promotions can be a good marketing tool. But plan them when they will help you, the dealer, boost sales, and use them wisely.

e only way you can sell VFD feed or supplements is with a complete written order from a veterinarian, similar to a doctor’s prescription. Once the order is filled, you must retain the directive and proof of sale/distribution. All records must be kept for two years, and be readily available to the FDA if requested for inspection/audit. The BioZyme® staff has created a sample form to make sure that you have a complete directive, and everything is in order before you sell any medicated feed. Visit the Online Dealer Center at www.biozymedealer.com and click on “Regulatory Center” to download the sample forms.

e only way you can sell VFD feed or supplements is with a complete written order from a veterinarian, similar to a doctor’s prescription. Once the order is filled, you must retain the directive and proof of sale/distribution. All records must be kept for two years, and be readily available to the FDA if requested for inspection/audit. The BioZyme® staff has created a sample form to make sure that you have a complete directive, and everything is in order before you sell any medicated feed. Visit the Online Dealer Center at www.biozymedealer.com and click on “Regulatory Center” to download the sample forms.